holkovo.ru

Prices

How To Learn Html Quickly

Practically if you give 2 hours a day, it will take at least 20 days to learn Html alone. You can use websites like tutorialbrain, w3schools, or. With our introduction to HTML and CSS complete, it's time to dig a little deeper into HTML and examine the different components that make up this language. Websites such as Codecademy, W3Schools, and Udemy offer interactive tutorials and courses on HTML and CSS. · Books and other print resources are a great way to. HTML & CSS are rather basic programming languages by modern standards, but learning them is almost required for anyone hoping to work in the web development. 1. Learn HTML for Beginners: The illustrated guide to Coding · 2. Head First HTML and CSS · 3. HTML and CSS Quick Start guide. · 4. HTML CSS in 8 hours · 5. HTML5. Learn HTML with this app for free. Learn offline with 50+ HTML Lessons. This HTML tutorial will teach you the latest standards of HTML. Welcome to Learn HTML! · Overview of HTML · Document structure · Metadata · Semantic HTML · Headings and sections · Attributes · Text basics. Whether you develop web sites or apps that use PHP, Java, or JavaScript, it is necessary to first understand HTML. Join an HTML course on Udemy, to begin a. How to learn HTML/CSS fast · 1. Finish holkovo.ru course on HTML/CSS. Codecademy's course is a free course. · 2. Read Jon Duckett's book: “. Practically if you give 2 hours a day, it will take at least 20 days to learn Html alone. You can use websites like tutorialbrain, w3schools, or. With our introduction to HTML and CSS complete, it's time to dig a little deeper into HTML and examine the different components that make up this language. Websites such as Codecademy, W3Schools, and Udemy offer interactive tutorials and courses on HTML and CSS. · Books and other print resources are a great way to. HTML & CSS are rather basic programming languages by modern standards, but learning them is almost required for anyone hoping to work in the web development. 1. Learn HTML for Beginners: The illustrated guide to Coding · 2. Head First HTML and CSS · 3. HTML and CSS Quick Start guide. · 4. HTML CSS in 8 hours · 5. HTML5. Learn HTML with this app for free. Learn offline with 50+ HTML Lessons. This HTML tutorial will teach you the latest standards of HTML. Welcome to Learn HTML! · Overview of HTML · Document structure · Metadata · Semantic HTML · Headings and sections · Attributes · Text basics. Whether you develop web sites or apps that use PHP, Java, or JavaScript, it is necessary to first understand HTML. Join an HTML course on Udemy, to begin a. How to learn HTML/CSS fast · 1. Finish holkovo.ru course on HTML/CSS. Codecademy's course is a free course. · 2. Read Jon Duckett's book: “.

Learn HTML CSS is the easiest, most interactive way to learn & practice modern HTML and CSS online. Learn in an interactive environment. holkovo.ru is a free interactive HTML tutorial for people who want to learn HTML, fast. Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java. Now, moving in a very fast-growing world, it becomes necessary for you to move ahead with the flow. You also might be wanting to learn things very fast. When it. Hands-on learning. AI-assisted learning. Make progress faster with our AI Learning Assistant, a tool that automatically understands your current course. Learn the basics of HTML5 and start building & editing web pages. Elements and Structure. Learn about HTML elements and structure, the building blocks of. I've seen many people chose a more difficult programming language as their first, such as C++ or Java and they lost interest in it quickly. HTML is easy to type. holkovo.ru is a free interactive HTML tutorial for people who want to learn HTML, fast. Learning HTML is a great skill for many reasons. It's useful for creating websites, apps and other digital projects — and also works well. This course will teach you HTML and CSS through building and deploying five awesome projects. It is also fully interactive, with over 75 coding challenges. It defines the structure of a page, while CSS defines its style. HTML and CSS are the beginning of everything you need to know to make your first web page! Use DOCTYPE in your html pages, start with transitional since it has the most lax rules, and validate your html. · Pick what browsers you will. Step 1 · Step 2 — Learn by Doing (Beginner) · Step 3 — Understand HTML Layouts (Advanced) · Step 4 — Understand HTML Forms (Advanced) · Step 5 —. This is a foolproof way of learning HTML fast! Take this course if you want to learn HTML in a fast and efficient way. Why take this course? Currently the. Now, moving in a very fast-growing world, it becomes necessary for you to move ahead with the flow. You also might be wanting to learn things very fast. When it. My advice as a web developer of many years and an educator: recognize and exploit the various methods and starting points for learning this vast. Learning basic HTML+CSS doesn't take long, but learning to use them well does take some time. You can quickly grasp their basic tags and labels in about one. 4 Tips for Learning HTML · Start with the Basics · Practice Regularly · Learn from Others · Keep up with the Trends. There are quite a few free resources available for learning HTML & CSS, you just need to know where to look. YouTube boasts a wide range of tutorials and. This is a foolproof way of learning HTML fast! Take this course if you want to learn HTML in a fast and efficient way. Why take this course? Currently the world.

If You Dispute Your Credit Report What Happens

If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file. If you dispute the debt, the debt collector cannot report it to a credit reporting agency unless and until it verifies the debt. If the debt collector has. When you dispute an error, the credit bureau is obligated to investigate your claim. If your claim is determined to be valid the data in. If you have more information that backs up your claim, you can submit a new dispute to the credit reporting agency. Be sure to provide fresh, relevant. However you filed your dispute, the credit bureau has 30 days to investigate it. · If the credit bureau considers your request to be “frivolous” or “irrelevant,”. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. The credit bureau cannot put the disputed information back in your file unless the creditor verifies the information. If that happens, the credit bureau must. Request a Dispute Statement: If the credit bureau does not remove the disputed information, you have the option to request that a statement of dispute be added. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file. If you dispute the debt, the debt collector cannot report it to a credit reporting agency unless and until it verifies the debt. If the debt collector has. When you dispute an error, the credit bureau is obligated to investigate your claim. If your claim is determined to be valid the data in. If you have more information that backs up your claim, you can submit a new dispute to the credit reporting agency. Be sure to provide fresh, relevant. However you filed your dispute, the credit bureau has 30 days to investigate it. · If the credit bureau considers your request to be “frivolous” or “irrelevant,”. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. The credit bureau cannot put the disputed information back in your file unless the creditor verifies the information. If that happens, the credit bureau must. Request a Dispute Statement: If the credit bureau does not remove the disputed information, you have the option to request that a statement of dispute be added. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute.

Credit Inquires by Former Creditors A bankruptcy discharge not only eliminates your debt, it also severs the relationship you had with that particular lender. Removing dispute wording could un-qualify you for the mortgage. When an account is disputed, it is sometimes, though not always, masked from consideration in. If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file. You should send a follow-up letter along with a copy of the original dispute letter if you do not hear back within 45 days. Additionally, when a creditor. In simpler terms: your credit report will be updated to show its disputed and your score may go down. Once you've submitted a dispute, we'll investigate and return your results. If we do find that information on your credit report needs to be updated, don't. For that reason, if you see an inaccuracy on one credit report, there's good reason to suspect the error appears in your iles at the other credit bureaus as. Luckily, federal law gives you the power to dispute errors on your credit report and get them corrected. At Ware Law Firm, we regularly help clients remove. Request a Dispute Statement: If the credit bureau does not remove the disputed information, you have the option to request that a statement of dispute be added. When you dispute your credit report, it's important to understand that the dispute itself does not cause your credit score to drop. In other words, you aren't. through our TransUnion Service Center, where you can: · Manage or fix any inaccuracies on your credit report · Place Fraud Alerts to protect your identity. If that's the case, ask the credit bureau to include your statement of the dispute in your file and in future reports. If requested, the credit bureau will also. What if I see a mistake on my credit report? Dispute it. Disputing mistakes or outdated things on your credit report is free. Both the credit bureau and the. A credit report dispute is when you request a change or update to your report. This is because you're disputing an entry in the report as being inaccurate. I filed a dispute regarding inaccurate information on my credit report. What must a furnisher do when it gets a direct dispute? · conduct a reasonable. For that reason, if you see an inaccuracy on one credit report, there's good reason to suspect the error appears in your iles at the other credit bureaus as. So if there are credit reporting errors showing up on those reports, it's important that you dispute the errors with the responsible credit bureaus and. If you find inaccuracies on your credit report, you can dispute the inaccurate information with the credit reporting agency. Follow up if you've seen no change after about three months. A Slice of Useful History: You're Not in This Alone. Errors on credit reports are, unfortunately. If you dispute your credit reports online, you make it difficult to enforce the law, and it slows you down. Eventually, if you are correct, it will require.

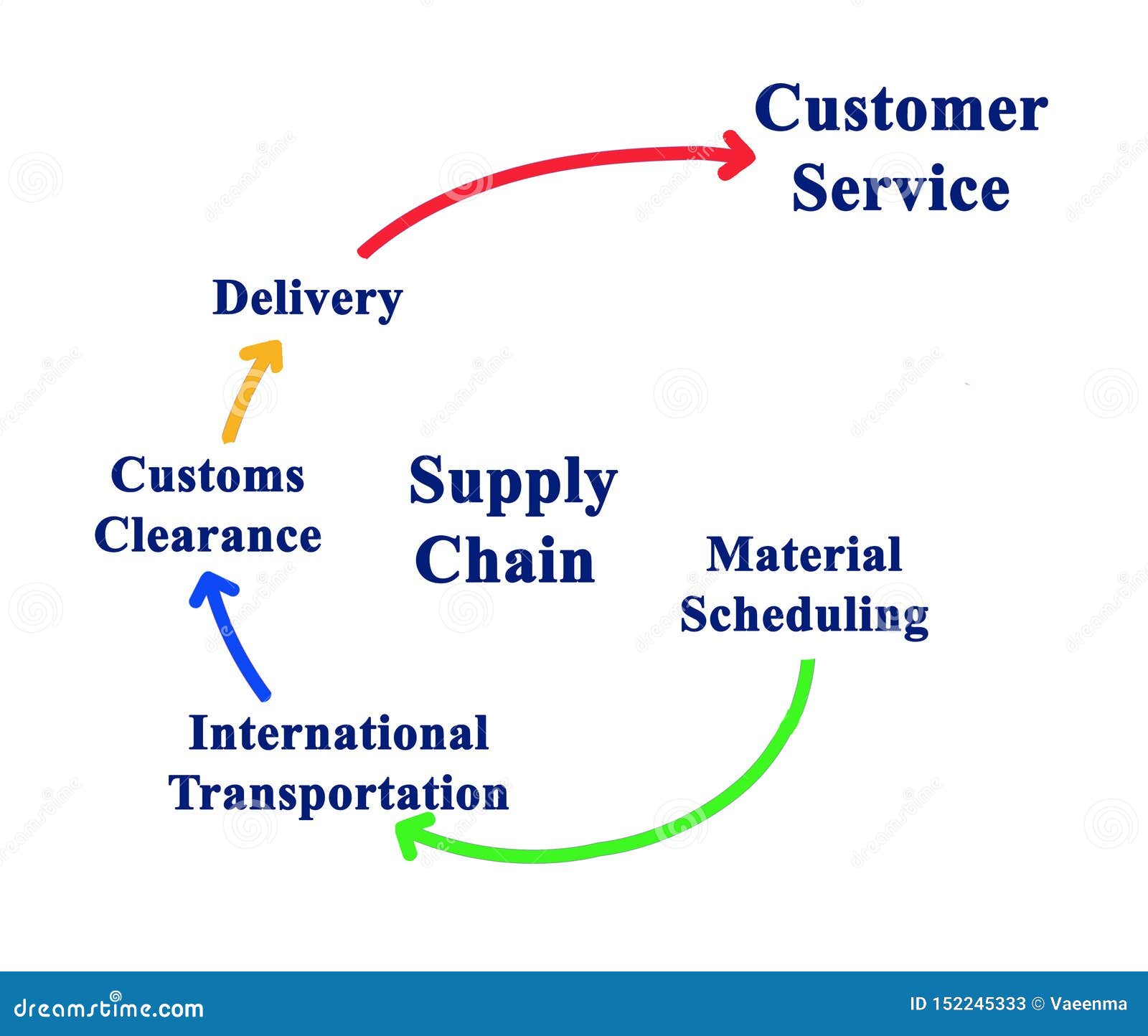

Components Of Supply Chain

6 Components of Supply Chain: 1. Supply Chain Planning 2. Procurement 3. Manufacturing 4. Logistics and Transportation 5. Warehouse and Stor. Supply chain management components, supply chain performance and organizational performance: a critical review and development of the conceptual model. Supply chain management (SCM) is the coordination of a business' entire production flow, from sourcing raw materials to delivering a finished item. Supply chain management acts as the manager of volume flow of products and services along with management of processes that creates a more systematic logistics. No matter how small or wide a supply chain is, there are five basic supply chain components that are always visible within supply chain processes. Principles of Marketing · Reading: Components of a Supply Chain · Introduction · Sourcing and Procurement · Demand Planning, Order Fulfillment, and Inventory. In this article, we will delve into the 4 basic components of supply chain management: planning, sourcing, making, and delivery. The supply chain is a network of processes, individuals, resources, and technology involved in the manufacturing and sale of products. The five most critical phases of SCM are planning, sourcing, production, distribution, and returns. A supply chain manager is tasked with controlling and. 6 Components of Supply Chain: 1. Supply Chain Planning 2. Procurement 3. Manufacturing 4. Logistics and Transportation 5. Warehouse and Stor. Supply chain management components, supply chain performance and organizational performance: a critical review and development of the conceptual model. Supply chain management (SCM) is the coordination of a business' entire production flow, from sourcing raw materials to delivering a finished item. Supply chain management acts as the manager of volume flow of products and services along with management of processes that creates a more systematic logistics. No matter how small or wide a supply chain is, there are five basic supply chain components that are always visible within supply chain processes. Principles of Marketing · Reading: Components of a Supply Chain · Introduction · Sourcing and Procurement · Demand Planning, Order Fulfillment, and Inventory. In this article, we will delve into the 4 basic components of supply chain management: planning, sourcing, making, and delivery. The supply chain is a network of processes, individuals, resources, and technology involved in the manufacturing and sale of products. The five most critical phases of SCM are planning, sourcing, production, distribution, and returns. A supply chain manager is tasked with controlling and.

An overview of the critical components of supply chain management reveals the intricate web of activities, processes, and relationships that. This can include sourcing, design, production, warehousing, shipping, and distribution. The goal of SCM is to improve efficiency, quality, productivity, and. What is supply chain management? SCM is the management of the flow of goods or services from source to destination by following activities like demand planning. Retail supply management encompasses the coordination and control of various processes involved in the flow of information, goods, and services from suppliers. 6 Components of Supply Chain: 1. Supply Chain Planning 2. Procurement 3. Manufacturing 4. Logistics and Transportation 5. Warehouse and Stor. A supply chain is a complex logistics system that consists of facilities that convert raw materials into finished products and distribute them to end. The components of supply chain management are planning, sourcing, inventory, transportation & warehousing, and returns. The key components to supply chain planning · Tech and Digitalization · Performance Optimization · Process Excellence · Change Management · Org Design and Talent. A supply chain transforms raw materials and components into a finished product that's delivered to a customer. It is made up of a complex network of. Supply chain management (SCM) is the coordination of a business' entire production flow, from sourcing raw materials to delivering a finished item. The five most critical phases of SCM are planning, sourcing, production, distribution, and returns. A supply chain manager is tasked with controlling and. What are the components of your supply chain you should be focusing on right now? · 1. INTEGRATION. Integration starts at your strategic planning phase and is. The 5 Basic Components of Supply Chain Management · 1. Planning. Planning process are the critical to allow supply chains to operate at maximum efficiency. · 2. In this article, we will cover the four main components of a resilient supply chain management. We will also investigate what interactions and relationships. Components of a Supply Chain. Next. A supply chain consists of all parties and functions involved, directly or indirectly, in fulfilling a customer request. The. From strategic planning to risk management, each element plays a crucial role in refining processes, ensuring punctual deliveries, and surpassing customer. These components include: 1. Information Sharing: Sharing timely and accurate information among all stakeholders is crucial for supply chain integration. The four components of supply chain are customers, retailers/distributors, manufacturers and suppliers. In commerce, supply chain management (SCM) deals with a system of procurement (purchasing raw materials/components), operations management, logistics and.

Cayman Islands Corporate Tax Rate

Corporate taxation. The corporate income tax rate in Cayman Islands is 0%. Transfer pricing. Cayman is the leading domicile for hedge funds; the second. 1. British Virgin Islands · 2. Cayman Islands · 3. Bermuda · 4. Netherlands · 5. Switzerland · 6. Luxembourg · 7. Hong Kong · 8. Jersey. The territory has no corporate income tax, no capital gains tax, and no withholding tax on dividends or interest payments. The Company's subsidiaries and VIEs in the PRC are governed by the Enterprise Income Tax Law (“EIT Law”), which became effective on January 1, Pursuant to. The fact that BVI and Cayman companies have no corporate taxes can make them particularly useful in fund structures, as one or more corporate vehicles can. Cayman Islands vs US Taxes In the Cayman Islands, there is no personal income tax levied on individuals, making it a unique tax environment. However, US. Tax is withheld at the rate of 30% from gross dividends distributed to non-residents. Interest. Best Rates30%; Domestic Rates 30%; Treaty. Unlike most countries, the Caymans don't have a corporate tax, making it an ideal place for multinational corporations to base subsidiary. Corporate Tax Rate in Cayman Islands is expected to reach percent by the end of , according to Trading Economics global macro models and analysts. Corporate taxation. The corporate income tax rate in Cayman Islands is 0%. Transfer pricing. Cayman is the leading domicile for hedge funds; the second. 1. British Virgin Islands · 2. Cayman Islands · 3. Bermuda · 4. Netherlands · 5. Switzerland · 6. Luxembourg · 7. Hong Kong · 8. Jersey. The territory has no corporate income tax, no capital gains tax, and no withholding tax on dividends or interest payments. The Company's subsidiaries and VIEs in the PRC are governed by the Enterprise Income Tax Law (“EIT Law”), which became effective on January 1, Pursuant to. The fact that BVI and Cayman companies have no corporate taxes can make them particularly useful in fund structures, as one or more corporate vehicles can. Cayman Islands vs US Taxes In the Cayman Islands, there is no personal income tax levied on individuals, making it a unique tax environment. However, US. Tax is withheld at the rate of 30% from gross dividends distributed to non-residents. Interest. Best Rates30%; Domestic Rates 30%; Treaty. Unlike most countries, the Caymans don't have a corporate tax, making it an ideal place for multinational corporations to base subsidiary. Corporate Tax Rate in Cayman Islands is expected to reach percent by the end of , according to Trading Economics global macro models and analysts.

Nonresident aliens and foreign corporations are subject to. U.S. taxation on certain amounts received from sources within the United States and income which is. The Withholding Tax Rate in Cayman Islands stands at 0 percent. Withholding Tax Rate in Cayman Islands averaged percent from until The Cayman Islands: A Zero Percent Corporate Tax Haven for Businesses · The Cayman Islands, renowned for their stunning natural beauty, are also celebrated as. In the Cayman Islands, there are no direct taxes. No corporation tax, income tax, capital gains tax, inheritance tax, gift tax, nor wealth tax. Certain. Although foreign companies in the Cayman Islands do not need to pay corporate tax rate, they must pay an annual renewal fee for the Cayman company. Traditional tax havens, like Jersey, are open about zero rates of taxation – as a consequence they have few bilateral tax treaties. Modern corporate tax havens. The corporate tax rate is 25%. For corporations subject to unlimited tax liability, there is a minimum corporate income tax of EUR 1, for limited liability. Corporate income tax - Cayman Islands does not levy corporate income tax. · Other taxes - There is no personal income tax nor capital gains nor corporation tax. There are no direct taxes in the Cayman Islands. So that means there is 0% income tax, 0% property tax, 0% corporate tax, 0% capital gains tax, 0% payroll tax. In simple terms, the Cayman Islands is a tax haven, because it does not impose a corporate tax. This makes it an ideal location for multinational companies. There is no income tax, company or corporation tax, inheritance tax, capital gains or gift tax. There are no property taxes or rates, and no controls on the. Orbitax Corporate Tax Rates Retained Statutory Tax Rate 0 Surtax Based on Taxable Income 0 Surtax Based on Statutory Tax 0 Surtax Deductible. Stamp duty. Stamp duty is payable on real estate transactions at a rate of 7,5%. The tax is also payable on transactions involving shares in real estate. The Cayman Islands do not have a corporate income tax. Thus, corporate profits are not taxed in any way on any level. Under the current laws of the Cayman Islands, the Company is not subject to tax on income or capital gains. Additionally, the Cayman Islands does not impose a. The Cayman Islands laws allow the location to be a tax haven through the fact that there is no corporate income tax, no payroll tax or Cayman Islands capital. Unlike most countries, the Caymans don't have a corporate tax, making it an ideal place for multinational corporations to base subsidiary. percent are of a "general corporate" nature. The general corporate business corporate income tax like the Cayman Islands to avoid entity- level tax. No Corporate Income Tax – Companies in the Cayman Islands don't have to pay corporate income tax and are not subject to taxation on their profits. Because of. The Cayman Islands is a tax-free country. No property tax, no income tax, no inheritance tax, no gift tax, no corporation tax and duty-free shopping.

Does 5g Internet Cost More

5G home internet uses wireless cellular technology to deliver internet to your home. Plans generally start at less than $50/mo. and service is widely available. What's more, self-setup is easy, and there are no contracts. Switch to How much does it cost? The Straight Talk Home Internet plan costs $45 per. Plans start at $35/mo. with Auto Pay & select 5G mobile plans. 5G Home. $/mo. Download speeds between 85 and Mbps; 2-year price guarantee; Save more than 40% monthly with a. more expensive plan is typically up to Mbps. In some markets, the costlier 5G Home Plus plan can reach up to 1 Gbps download speeds. This makes it an. Learn more about T-Mobile 5G Home Internet and get the answers to frequently asked questions about setup, cost, internet speed, coverage and more. The standalone price is $50/mo. for Verizon 5G Home or $70/mo. for 5G Home Plus when you include the $10/mo. autopay and paperless billing discount. The higher. The standalone price is $50/mo. for Verizon 5G Home or $70/mo. for 5G Home Plus when you include the $10/mo. autopay and paperless billing discount. The higher. That depends on the service. Some mobile carriers charge higher prices for 5G data plans due to the faster speeds and lower latency, which are seen as premium. 5G home internet uses wireless cellular technology to deliver internet to your home. Plans generally start at less than $50/mo. and service is widely available. What's more, self-setup is easy, and there are no contracts. Switch to How much does it cost? The Straight Talk Home Internet plan costs $45 per. Plans start at $35/mo. with Auto Pay & select 5G mobile plans. 5G Home. $/mo. Download speeds between 85 and Mbps; 2-year price guarantee; Save more than 40% monthly with a. more expensive plan is typically up to Mbps. In some markets, the costlier 5G Home Plus plan can reach up to 1 Gbps download speeds. This makes it an. Learn more about T-Mobile 5G Home Internet and get the answers to frequently asked questions about setup, cost, internet speed, coverage and more. The standalone price is $50/mo. for Verizon 5G Home or $70/mo. for 5G Home Plus when you include the $10/mo. autopay and paperless billing discount. The higher. The standalone price is $50/mo. for Verizon 5G Home or $70/mo. for 5G Home Plus when you include the $10/mo. autopay and paperless billing discount. The higher. That depends on the service. Some mobile carriers charge higher prices for 5G data plans due to the faster speeds and lower latency, which are seen as premium.

Save $15/month on 5G Home or $25/month on 5G Home Plus with Unlimited Ultimate, Unlimited Plus, or these no-longer-available plans: 5G Play More, 5G Do More. $55 /mo. with AutoPay, taxes and fees included. Our Unlimited home internet plan is ideal for streaming your favorite shows, video conferencing, homework and. Our best price! Unlimited 5G Home Internet, $35/month. No-contract monthly plan. · Get unlimited wireless and 5G Home Internet. Get it all for just $80/mo when. 5G networks can achieve speeds of 10 gigabits a second, making them 10 times faster than 4G networks. It means that previously intensive tasks, such as. Though T-Mobile only offers one home internet plan, it has no data cap, full 5G speeds anywhere available and it only costs $50 a month. The biggest downside to. The service is $60/mo. as a standalone if you don't bundle your cell plan with T-Mobile. With T-Mobile 5G you'll get download speeds up. If you prefer just internet, the monthly price is $50 with autopay and paperless billing, or $60 without. In either case, these internet prices are guaranteed. T-Mobile is the best 5G home internet provider for most people. It has unparalleled availability, incredible speeds, and a low price. Stay securely connected with the network you can depend on.*. Secure. Get 24/7 Learn more at holkovo.ru **Requires compatible device/service. Fiber internet infrastructure is more costly to install but less expensive on the consumer's end. The most reliable option is 5G. Fiber cables are. You can get it for $40 a month if you have a legacy plan with a qualifying voice line with T-Mobile. Even at $40 the price is excellent for. Wi-Fi typically has a lower initial cost when it comes to hardware, as 5G chipsets are more expensive than wireless network cards. For enterprises, 5G hardware. Limited coverage since 5G networks aren't available in all areas, and can be spotty in some locations. · Expensive infrastructure in new cell towers and. 5G Home. $/mo. Download speeds between 85 and Mbps; 2-year price guarantee; Save more than 40% monthly with a. A good 5G router increases network reliability and speed, which can increase productivity, improve the customer experience, and more. The Costs of 5G Routers. Unsurprisingly, at least for the carriers that have launched so far, unlimited 5G rates are more expensive than 4G. Based on carrier data, the average monthly. 5G home internet is sold as a range of speeds all at the same price because they cannot yet control for quality. 5G home internet is capable of reaching speeds. Reliable 5G home internet for a great low price · BUNDLE TO GET HOME INTERNET AT JUST $/MO. · Home Internet at prices your budget will love · Discover the. While Verizon 5G Home Internet offers two plans — one more than T-Mobile 5G Home Internet — its top speeds cost $70 per month once the AutoPay discount is. If 5G home internet is available in your area, it's worth looking into for the maximum speeds and prices alone. However it may not be the best fit for.

Best Things To Buy On Credit Card

Time to Read · Is a rewards credit card a good choice? · Under what circumstances will the card issuer reduce or revoke rewards? · Does the card offer additional. Want to earn rewards? Open a cash rewards or cash back credit card If you plan to use your credit card for everyday spending and don't want to have to think. Personal finance experts weigh in on which expenses you should reconsider using a card to pay for so you can avoid credit creep and stay out of debt. Used responsibly, a credit card can be a very helpful financial tool. Making consistent, on-time payments can boost your credit rating, and some cards offer. If the bulk of your budget goes toward food and transportation, for instance, you'll do better with a card that offers cash back at grocery stores and gas. Charges no interest on things you buy (not cash withdrawals), usually You normally need to have a good credit history to get a standard credit card. One of the reasons why credit cards are best used for large purchases is the protection you get in accordance with Section 75 of the Consumer Credit Act. This. Paying household items on credit cards such as groceries, personal care items or cleaning supplies is also not the best idea. Purchasing these items will cost. Depending on the type of card you have, you should always buy appliances and electronics on credit. Beyond any points that you might earn, many credit cards. Time to Read · Is a rewards credit card a good choice? · Under what circumstances will the card issuer reduce or revoke rewards? · Does the card offer additional. Want to earn rewards? Open a cash rewards or cash back credit card If you plan to use your credit card for everyday spending and don't want to have to think. Personal finance experts weigh in on which expenses you should reconsider using a card to pay for so you can avoid credit creep and stay out of debt. Used responsibly, a credit card can be a very helpful financial tool. Making consistent, on-time payments can boost your credit rating, and some cards offer. If the bulk of your budget goes toward food and transportation, for instance, you'll do better with a card that offers cash back at grocery stores and gas. Charges no interest on things you buy (not cash withdrawals), usually You normally need to have a good credit history to get a standard credit card. One of the reasons why credit cards are best used for large purchases is the protection you get in accordance with Section 75 of the Consumer Credit Act. This. Paying household items on credit cards such as groceries, personal care items or cleaning supplies is also not the best idea. Purchasing these items will cost. Depending on the type of card you have, you should always buy appliances and electronics on credit. Beyond any points that you might earn, many credit cards.

Start by thinking about what you want to use the credit card for. This could be to buy things on line or on holiday, to pay your bills or to spread the cost of. Earn rewards: Using your credit card for everyday purchases may help you earn rewards that can be redeemed for cash back, gift cards or even used towards travel. Finance your purchases with one of our flexible credit products. Or use money from your PayPal Balance account with the PayPal Debit Card. A credit card is a great way to start building up your credit, which is especially important for international students who do not have credit history in the. Credit cards offer great purchase protections and should be used for many big-ticket purchases. But buying something on credit when you can't afford to pay it. What you need to know. How does deferred interest financing work at Best Buy? With the My Best Buy® Credit Cards, you can take advantage of various deferred. things you should consider before using them. Prepaid cards cannot be used for credit card payments or car payments. You cannot split payments online so you. Costco Anywhere Visa® Card by Citi: Best feature: Costco rewards. REI Co-op Mastercard®: Best feature: Retail rewards with travel insurance. My Best Buy Visa®. When can I use credit? Many people use a credit card to buy everyday things. You might use a credit card to pay for: Loans usually are for more expensive. Paying household items on credit cards such as groceries, personal care items or cleaning supplies is also not the best idea. Purchasing these items will cost. 1 The best cash-back cards are those that charge minimal fees and interest, while offering a high rewards rate. Some cards, like the Fidelity Rewards card. You can buy things online without a credit card using a debit card, prepaid card, gift card, mobile payment app, and even cryptocurrency. Perhaps you swipe your Citi Double Cash® Card to earn up to 2% cash back with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those. Used responsibly, a credit card can be a very helpful financial tool. Making consistent, on-time payments can boost your credit rating, and some cards offer. Best travel credit cards · Bank of America® Premium Rewards® credit card: Quality rewards and several valuable perks give this card a nice value for the annual. eGifter Accepts Credit Cards for Gift Cards. See why eGifter is your best option for Gift Cards with credit card. Desktop & Mobile App. Use credit cards to. Earn an extra % on everything you buy (on up to $20, spent in the first year) — worth up to $ cash back. That's % on travel purchased through Chase. Each dollar you spend on gift cards might help you earn points, depending on the credit card you use and its rewards program. You can redeem rewards and points. Purchases to Make on Your Credit Card · 1. Big Ticket Items · 2. ATMs and Gas Stations · 3. Restaurants · 4. Online Purchases · 5. Service Providers · 6. Travel. How do I use credit? · You borrow money (with your credit card or loan). · You buy the thing you want. · You pay back that loan later – with interest.

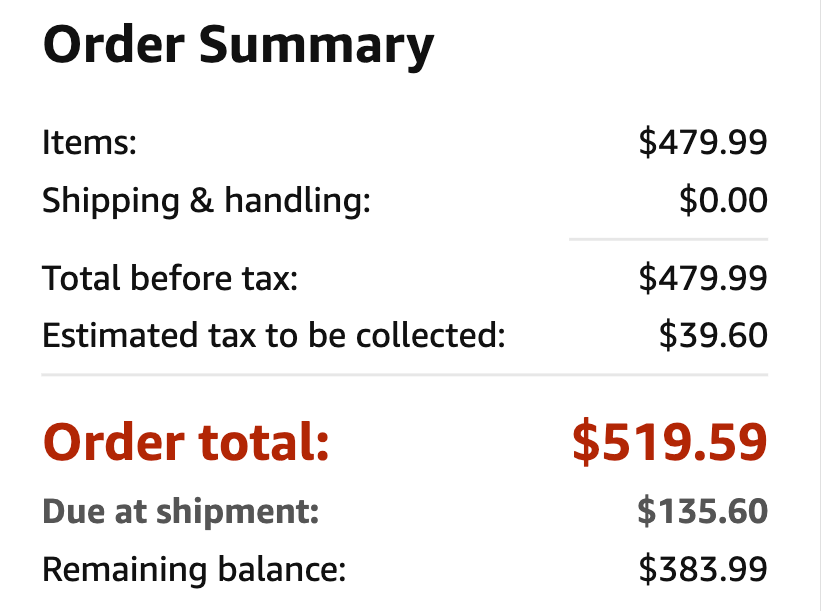

Amazon 6 Month Payment Plan

Visit the Monthly Payments page and click “Enable monthly payments.” Find an eligible product and select monthly payments. Products eligible for. 25% down payment then three payments of 25% every two weeks for 6 weeks. The monthly payment options they offer along with the interest rates NO WAY. I've used Amazon Monthly Payments 5 times already for items between $ and $ Always payed on time with no issues. To be honest I don't. Buy now, pay later allows you to make purchases when you want and pay for them in the period of time that best suits your needs from among the options offered. You are still responsible for payments based on your original loan terms. Pay Monthly: All returns are subject to the merchant's return and cancellation policy. This offer applies to a limited number of qualifying products, and Amazon reserves the right to limit the number of Monthly Payments plans that you may have. Pay Over Time with Affirm is available as equal monthly payment options during checkout for eligible orders over $ Pay Over Time with Affirm can be used. About Installments · Installment Plan: 3, 6, 12 months · Interest Rate: 0% · Processing Fees: 3 months: %; 6 months: %; 12 months: 3%. Limited Time Offer on qualifying Amazon Pay purchases: 6 equal monthly payments with 0% interest on eligible purchases of $ or more with your Amazon Store. Visit the Monthly Payments page and click “Enable monthly payments.” Find an eligible product and select monthly payments. Products eligible for. 25% down payment then three payments of 25% every two weeks for 6 weeks. The monthly payment options they offer along with the interest rates NO WAY. I've used Amazon Monthly Payments 5 times already for items between $ and $ Always payed on time with no issues. To be honest I don't. Buy now, pay later allows you to make purchases when you want and pay for them in the period of time that best suits your needs from among the options offered. You are still responsible for payments based on your original loan terms. Pay Monthly: All returns are subject to the merchant's return and cancellation policy. This offer applies to a limited number of qualifying products, and Amazon reserves the right to limit the number of Monthly Payments plans that you may have. Pay Over Time with Affirm is available as equal monthly payment options during checkout for eligible orders over $ Pay Over Time with Affirm can be used. About Installments · Installment Plan: 3, 6, 12 months · Interest Rate: 0% · Processing Fees: 3 months: %; 6 months: %; 12 months: 3%. Limited Time Offer on qualifying Amazon Pay purchases: 6 equal monthly payments with 0% interest on eligible purchases of $ or more with your Amazon Store.

Buy now, pay later at Amazon with Sezzle to get interest-free financing and pay in 4 easy, budget friendly installments - no hard credit check. With Afterpay, customers can buy what they want today and pay it off in four equal interest-free installments over 6 weeks. This payment plan is a convenient. Buy now and pay later at Amazon. Enjoy the flexibility to pay however you like. Create and use the One-time card instantly. Split your purchase into smaller. This date cannot be changed. Monthly installments show as 'charged' or 'posted' on your account. In addition to your monthly installment payments, the full. The required monthly payments is the purchase price (including tax and shipping) divided equally by the duration of the offer period (i.e. pay $25/month for. Here's how it works · Pay in equal monthly payments. Rates are between % APR. · Here's what a payment plan for a $ purchase at 20% APR could look. With 6 and 12 month* payment options now available, you can choose the plan that works best for your budget. More time to pay. Get up to 12 months to pay. Cons · Make equal monthly payments for 6 months on holkovo.ru purchases of $ or more and pay no interest. · Make equal monthly payments for 12 months on Amazon. Amazon's new policy of charging the credit card the full amount and paying it off over 6 or 12 months is a sham. Enjoy the flexibility of 6,12, or month payment plans, $0 down, and no sign-up “fees” or late fees. * Soft credit check may be needed but will not affect. Amazon Pay will now offer you the convenience of equal monthly payment options on eligible purchases of $50 or more. You can enjoy 0% APR financing for 6 or. If you have chosen equal monthly payments as your default payment option and equal monthly payments is available on your purchase, 1-Click orders and purchases. So, if you purchase something for $, you have six months to pay it off. Your payments would be $75 per month ($ ÷ 6). Customers who carry a balance beyond. With Afterpay, customers can buy what they want today and pay it off in four equal interest-free installments over 6 weeks. This payment plan is a convenient. Products eligible for financing through Monthly Payments feature the text “or 5 monthly payments” below the standard price on the product. With 6 equal monthly payments on qualifying Amazon Pay purchases of $ or more. holkovo.ru Easy, secure and fast. Chase Pay Over Time℠. Break purchases into equal monthly payments with no interest, just a fixed monthly fee. Go to holkovo.ru holkovo.ru: installment payment plan items. monthly payments products only · amazon payment plan items only · installment+. Select your equal monthly payment plan from the available offers, review and agree to the terms and conditions. Step 3. Pay over time. After you place your. Pay in equal monthly payments. Rates are between % APR. 3 or 6 months on purchases of $50 or more.

Virtual Credit Card Linked To Bank Account

When you save a credit or debit card to your Google Account, you may be able to turn on a virtual card number. Virtual card numbers can be shared with. For online shoppers, virtual cards offer an extra layer of protection. Unlike your regular debit or credit card, a virtual card isn't directly linked to your. Fast, temporary solution. Easily and quickly send a temporary virtual credit card to make business purchases without using a personal credit card. The virtual card is only active 15 days after you open your GO2bank account or until you activate your personalized debit card (whichever happens first). If you. A virtual credit card works by providing a digital version of your physical credit card, designed specifically for online and remote transactions. bunq Virtual Credit Cards are digital Mastercard Credit Cards that you instantly create and use for any purpose. Link them to different Bank Accounts. Virtual cards work exactly like your physical bank card—they just live in your digital wallet on your phone instead of your physical wallet. While they are referred to as cards, they are simply random numbers that are linked to your existing credit card or bank account. The numbers can't be used. A virtual card number is linked to your credit card account, and is a unique set of 16 numbers, CVV and expiration date that's instantly generated for one-time. When you save a credit or debit card to your Google Account, you may be able to turn on a virtual card number. Virtual card numbers can be shared with. For online shoppers, virtual cards offer an extra layer of protection. Unlike your regular debit or credit card, a virtual card isn't directly linked to your. Fast, temporary solution. Easily and quickly send a temporary virtual credit card to make business purchases without using a personal credit card. The virtual card is only active 15 days after you open your GO2bank account or until you activate your personalized debit card (whichever happens first). If you. A virtual credit card works by providing a digital version of your physical credit card, designed specifically for online and remote transactions. bunq Virtual Credit Cards are digital Mastercard Credit Cards that you instantly create and use for any purpose. Link them to different Bank Accounts. Virtual cards work exactly like your physical bank card—they just live in your digital wallet on your phone instead of your physical wallet. While they are referred to as cards, they are simply random numbers that are linked to your existing credit card or bank account. The numbers can't be used. A virtual card number is linked to your credit card account, and is a unique set of 16 numbers, CVV and expiration date that's instantly generated for one-time.

This information is tied to your card account but doesn't match the information on your physical credit card. A virtual credit card helps protect you against. bunq Virtual Credit Cards are digital Mastercard Credit Cards that you instantly create and use for any purpose. Link them to different Bank Accounts. You can use the virtual API that has been provided to you by the bank or card issuer to generate virtual credit cards with digit card numbers and CVV codes. Virtual cards give you easy access to account funds, and the temporary card information makes online transactions more secure. Elevate your financial management with Veem's new Virtual Card. Unlike debit cards with annual and transaction fees, your Virtual Card is fee-free. You can add your virtual card to Apple Pay™, Google Pay™, or use it online anywhere that Visa® is accepted. What are the differences between my physical and. Make payments online and freeze your virtual debit card after each purchase. · Have up to 3 virtual cards at a time, and use them to manage your spending by. Virtual cards function just like a credit or debit card but without the physical card, and can be used for online shopping, over the phone purchases, or any. Buying from a website you've not used before, or making a payment over the phone? Use a virtual card - the details are only linked to the money in your Space. Currently, three major card issuers offer virtual card numbers, including American Express, Capital One and Citi. Chase and Discover do not currently offer. Virtual credit cards need to be linked to a traditional credit card account A virtual card that is tied to a bank account will generate random information to. Go to your PayPal wallet, click on "Link a card or bank," and follow the instructions to add your virtual Visa card. 2. Add funds to your PayPal. Many online accounts offer instant virtual debit cards. Notable fintechs include Chime, Revolut, Wise, N26, Dave, Current, Monese, and Monzo. These banks. As the name suggests, a virtual debit card or a virtual credit card is a card that is conjured and exists online only. They possess a randomly generated As the name suggests, a virtual debit card or a virtual credit card is a card that is conjured and exists online only. They possess a randomly generated Virtual credit cards are a highly secure digital payment method that streamline the accounts payable process. Virtual card payments simplify reconciliation for. Once you've added money to your account, you can use your virtual temporary card for online purchases until your personalized Bluebird debit card arrives. Log. Virtual credit cards are completely legal as they are issued by major banks and companies that are % trusted. You can save the card details on your device. A virtual card is a unique, randomly generated digit number for each transaction. Accounts payable. Pay invoices and purchase orders with virtual cards. So what is a virtual credit card and how does it work? Simply put, a virtual credit card is a unique credit card number tied to your main credit card account.

Route Money To An Account

Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Need to Move or Send Money? You've Got Options. Transferring funds to and from your PSECU account is a breeze with 24/7 digital banking access. Have questions. To make a wire transfer, you'll need the recipient's name and address and their bank account and routing numbers. Call, visit or go online with your bank or a. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. Receiving Transfers. Wire deposits can be made to your savings, checking or Money Market Savings Account, as well as to any loan, credit card, mortgage. You can use the bank where you have a checking or savings account to conduct your international money transfer or open an account with various companies that. Bank and wire transfer services may require: · The sender's valid government-issued photo ID or driver's license · The sender's full name and contact. To get started, select the accounts you would like to transfer money From and To. To transfer money between accounts at Wells Fargo and accounts at another bank. Wire transfers are an efficient way to send electronic funds to people and organizations across the globe. They tend to be a preferred option when transferring. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Need to Move or Send Money? You've Got Options. Transferring funds to and from your PSECU account is a breeze with 24/7 digital banking access. Have questions. To make a wire transfer, you'll need the recipient's name and address and their bank account and routing numbers. Call, visit or go online with your bank or a. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. Receiving Transfers. Wire deposits can be made to your savings, checking or Money Market Savings Account, as well as to any loan, credit card, mortgage. You can use the bank where you have a checking or savings account to conduct your international money transfer or open an account with various companies that. Bank and wire transfer services may require: · The sender's valid government-issued photo ID or driver's license · The sender's full name and contact. To get started, select the accounts you would like to transfer money From and To. To transfer money between accounts at Wells Fargo and accounts at another bank. Wire transfers are an efficient way to send electronic funds to people and organizations across the globe. They tend to be a preferred option when transferring.

Transfer Between Accounts · Transfers to external bank accounts: $5, daily and $25, within 30 days · Transfers from external bank accounts: $5, daily and. Wire transfers are sent electronically across a network of banks or transfer agencies around the world. · You must pay for a wire transfer when it's sent by the. $, limit per wire transaction initiated through Regions Online Banking Business Services applies. Limit of $, in aggregate transactions per month. Wire transfers allow you to send and receive large amounts of money quickly and securely Card Payment Processing · Accounts Payable. Empower Your Business. One of the fastest ways to transfer money between bank accounts is with an ACH debit, provided both accounts are linked. To link accounts and set up a transfer. How do I send money using PayPal? · Go to Send. · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the currency. I am foreign and in my country, people just provide the bank name, account holder name and bank account number for us to transfer funds. In the. Use the Chase Mobile® app to send wire transfers: · Sign in to the Chase Mobile® app. · Tap Pay & transfer in bottom menu. · Choose "Wires and global transfers". Wire Transfer. Wire transfers will move money by transferring from your bank to ours. We usually receive money in 24 hours. Card payments typically take. Click 'Send now' to start the online money transfer; Enter your destination and the amount you'd like to send with a bank account. Select 'Cash pickup'. Link. A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. The sender is the one who. To perform a transfer, sign in to your account and select Transfers from the navigation menu. You'll need to know the account number and transit routing number. Transfer money from one bank account to another · Once you're logged in, select "link accounts," "add an account," "add external accounts," or something similar. Wire Transfer Requirements. BECU requires funds that are not from a confirmed source to be in the account at least 10 business days prior to sending a wire. 8 Low-Cost Ways to Transfer Money · Your Bank · Zelle · PayPal and Venmo · Western Union or MoneyGram · Physical Cash · Personal Checks · Bank Drafts, Money Orders. Select your preferred online payment option – directly from your bank account, debit or credit card2. Then, choose the 'Direct to Bank Account' or 'Account. Transfer in 1 to 3 business days to a bank account · On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button the more button, then tap. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer in minutes using the U.S. Bank Mobile App or online banking. You can send money with a credit card, debit card, or bank account. Some payment methods are more affordable while others are faster. For example, when you send.

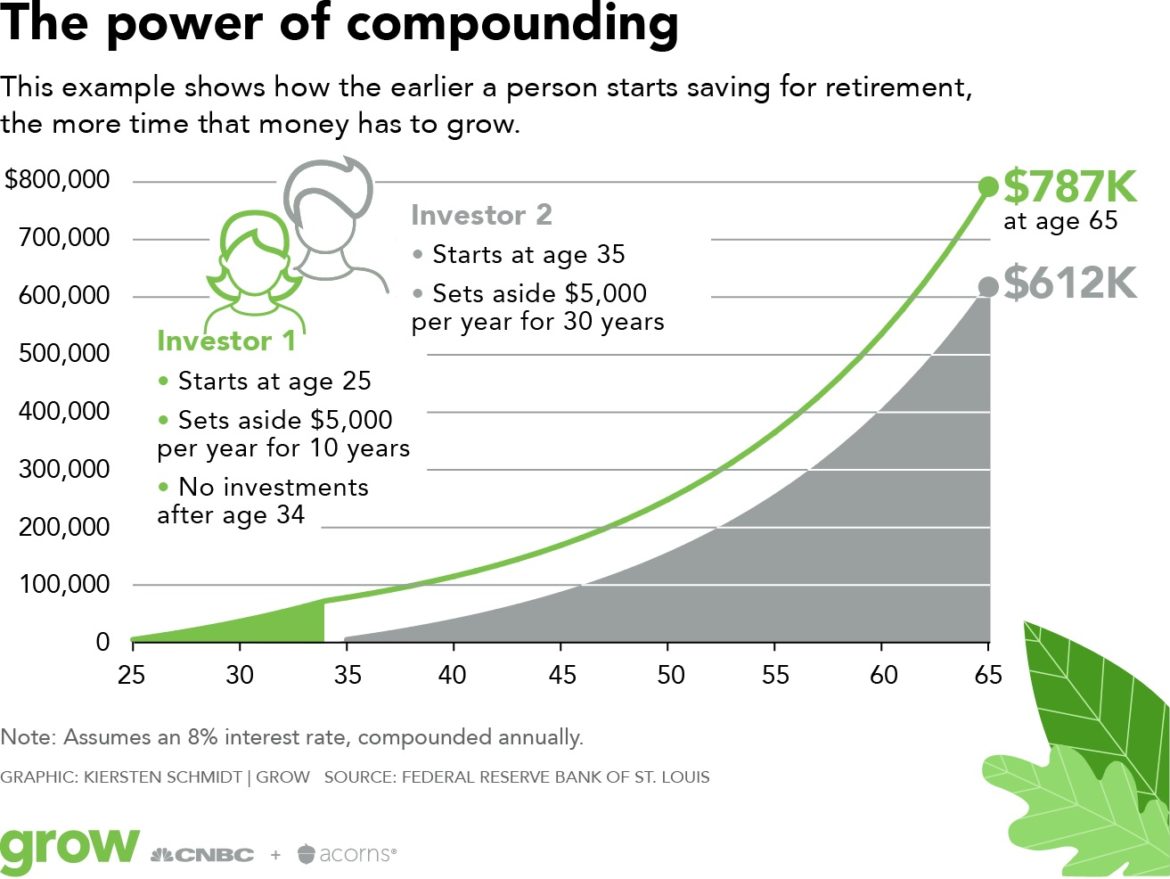

Gaining Interest On Savings

A savings account is a type of bank account that allows you to safely save money while earning interest. Savings can come in the form of a relationship savings. The major Canadian banks currently offer interest rates on USD deposits ranging from % pa (not a typo!) to % pa (RBC and Bank of Nova Scotia). Compounding, compound interest - Compounding is the process of adding interest to your principal balance. Suppose you have $1, in an HYSA that is earning 4%. We can assist you with finding the best savings account option to meet your needs. When do I start earning interest on my savings account? Interest begins. When you set up Savings, you're agreeing to have future Daily Cash automatically deposited into your account — this allows you to earn interest on the Daily. Grow your savings with our high-interest savings account. Earn % APY 1 guaranteed for the first 5 months. When you deposit money into a savings account, you may earn interest. This interest is deposited into your account and in the next month, you earn interest on. Growth Savings % APY · Earn Interest, With Impact. Every cent you save earns interest for you and helps support a brighter, more sustainable future for the. How much of a difference does this make? If you deposit $50, into a traditional savings account with a %, you'll earn just $ in total interest after. A savings account is a type of bank account that allows you to safely save money while earning interest. Savings can come in the form of a relationship savings. The major Canadian banks currently offer interest rates on USD deposits ranging from % pa (not a typo!) to % pa (RBC and Bank of Nova Scotia). Compounding, compound interest - Compounding is the process of adding interest to your principal balance. Suppose you have $1, in an HYSA that is earning 4%. We can assist you with finding the best savings account option to meet your needs. When do I start earning interest on my savings account? Interest begins. When you set up Savings, you're agreeing to have future Daily Cash automatically deposited into your account — this allows you to earn interest on the Daily. Grow your savings with our high-interest savings account. Earn % APY 1 guaranteed for the first 5 months. When you deposit money into a savings account, you may earn interest. This interest is deposited into your account and in the next month, you earn interest on. Growth Savings % APY · Earn Interest, With Impact. Every cent you save earns interest for you and helps support a brighter, more sustainable future for the. How much of a difference does this make? If you deposit $50, into a traditional savings account with a %, you'll earn just $ in total interest after.

High-yield savings accounts are a flexible and easy way to earn interest while saving money. They are perfect for short-term savings projects like creating. The formula for calculating simple interest is A = P x R x T. Here's how the simple interest formula looks if the initial deposit is $1,, the annual. High growth savings account · Earn interest monthly · Used both of your free transactions? No problem! · Additional services charges* · Explore all accounts · Ways. Our High Interest Rate Savings account gives you all the flexibility of a basic savings account and a higher interest rate. No monthly fee; Earn daily interest. Generally, checking accounts don't earn interest. However, they do offer other important banking benefits. No Fees. No monthly account fees and no minimum balance requirement. ; Competitive Rates. Earn % APY — well above the national average. ; FDIC Insured. Bank. High yield savings accounts often offer interest rates several times the national average. In some cases, you could earn far more than in traditional savings. No Fees. No monthly account fees and no minimum balance requirement. ; Competitive Rates. Earn % APY — well above the national average. ; FDIC Insured. Bank. High-yield savings accounts are a great place to help you earn interest on your savings. Currently, the top high-yield savings accounts pay up to % APY. 1. Maintain high average balances in savings account. · 2. Consolidate savings accounts spread over several banks if needed, and keep it in a. Savings accounts are designed to hold your money and earn some interest, although that will vary based on the type of account. For instance, a high-yield. As of Aug. 19, , the national average rate for savings accounts was %, according to the FDIC. You can check out the best high-yield savings. Compounding is, essentially, earning interest on interest earned. As a savings account accrues interest, it gradually increases the total principal — increasing. To increase the income from your Savings Account, consider the following tips: Look for trusted banks to open a Savings Account. Using a savings calculator allows you to see how fast your money will grow when put in an interest-earning account. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. Ideas to Earn More Interest on Savings Account · 1. Maintain High Monthly Average Balance · 2. Choose from a Wide-Range of Savings Accounts · 3. Link Your FDs. Post student loans are charging % interest. MoneySavingExpert explains how interest and repayment really works and if you should pay yours off. Savings accounts offer one of the simplest ways to earn interest on the money you have. They offer higher interest rates than a regular checking account, while. Banks offer interest rates on savings accounts in order to attract deposits, which they lend out to other consumers in the form of mortgages, business loans and.